Contents

Mergers and acquisitions (M&A) can be difficult to plan and execute, not to mention the challenge of integrating the acquired organization into the business. One way businesses are responding is by incorporating AI in M&A processes.

Nearly all executives at corporations (90%) and private equity firms (93%) surveyed for a Deloitte report on M&A trends in 2023 agreed that the success of M&A deals is “highly dependent on effective transformation planning and execution.” Without this, companies risk integration issues, cultural clashes and operational inefficiencies that jeopardize return on investment.

Artificial intelligence (AI) can help companies connect employees with the expertise they need, reduce inefficiencies and redundancies, and free them up to create value. The M&A process itself can be accelerated with AI-powered solutions that help businesses improve performance and profitability

Learn more about how businesses can use AI to address M&A challenges, including planning and execution. You’ll also discover how AI can help companies improve knowledge access, collaboration, customer service and more.

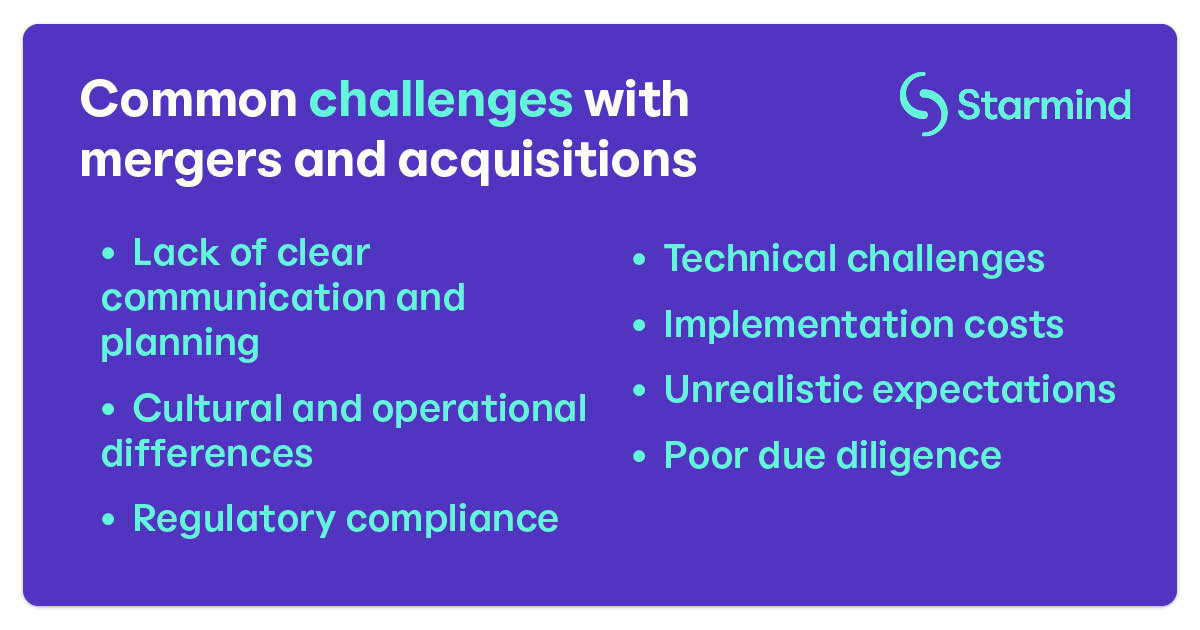

Common challenges with mergers and acquisitions

More than 90% of M&A transactions are completed, according to Bloomberg data, but that doesn't mean even the ones that close are successful. Deals face challenges related to obtaining regulatory approval, negotiating terms, winning over stakeholders and operationally integrating the companies. Let’s look at some of these obstacles.

Lack of clear communication

During and after the deal-making process, business leaders must communicate updates, assign ownership of key responsibilities and explain to employees and other stakeholders what’s happening and how the deal affects them. According to McKinsey research, without a clear, structured communication plan, companies create confusion and resistance while reducing engagement and productivity. Even if the deal doesn’t fall through, implementation becomes harder.

Cultural differences

Cultural differences encompass communication styles, decision-making processes and organizational values, as well as societal norms and other areas. These differences create misunderstandings, resistance to change and a lack of alignment in goals and objectives.

Employees from either business can struggle to adapt to new ways of working that don’t feel familiar — regardless of whether the changes would benefit them. Unaddressed, these differences can reduce productivity and increase discontent and turnover.

Operational differences

Operational differences arise from variations in systems, processes and procedures between the two entities. These disparities can lead to inefficiencies and coordination challenges. Without a clear plan to address these differences, the M&A process may encounter delays, increased costs and missed opportunities.

Merging organizations likely have overlapping and duplicate technologies, databases and software applications. This can slow down integration, especially if there’s no definitive inventory or if vendor contracts prevent swift changes. Without a strong technology implementation plan, the combined entity can suffer from silos, data inconsistencies, interoperability issues and delays.

Regulatory compliance

Many M&A deals must obtain regulatory approval in one or more jurisdictions. The acquirer might need to present evidence of the deal’s legality. Sometimes, to assuage anti-competitive concerns, the acquirer must offer concessions to win approval, such as the divesting of certain business units.

Organizations must conduct thorough antitrust assessments to avoid penalties and legal challenges. They must also have certainty on what assets are most important to the combined entity and which assets can be divested if regulators insist.

Unrealistic expectations

Organizations may expect immediate and significant benefits from M&A without fully understanding the time, effort and resources required for successful integrations.

Unrealistic expectations can arise from factors, such as overestimating synergies, underestimating cultural differences or failing to consider operational complexities. This can lead to disappointment, frustration and a sense of failure if the expected outcomes aren't achieved within the anticipated timeframe.

Poor due diligence

Due diligence is the process of conducting a comprehensive assessment and investigation of the acquisition target company to evaluate its financial, legal, operational and strategic aspects. Acquirers add risk if they fail to identify potential risks, liabilities or other issues that affect the deal’s viability or return on investment, making this a critical board-level responsibility, according to Deloitte.

Benefits of using AI in mergers and acquisitions

While the M&A process can be complex and challenging, AI is an emerging tool for businesses looking to streamline and automate tasks. Here are some of the key benefits of using AI in M&A.

Maximizing available resources

When using AI to augment existing human and technology resources, organizations can increase productivity with minimal changes to workflows and without hiring additional people. AI-powered solutions can also help companies catalog and audit their resources, gaining insights into what’s available and its current and potential value. Organizations can make better-informed decisions about deploying resources to speed up integration, drive growth, improve efficiency and maximize profitability.

Retaining knowledge

During M&A, there's a risk of losing critical knowledge and expertise because of layoffs or because employees depart. This risk is heightened by poor M&A integration efforts that fail to catalog and organize existing knowledge.

AI technology can be used to capture, organize and store vast amounts of information, including documents, reports and employee insights, and create knowledge bases. These repositories serve as centralized platforms where employees can get out of their silos and access and share crucial information. AI tools can identify key topics, trends and expertise areas, help employees perform search queries, and connect them with internal experts who can verify information and add insight and context.

Minimizing disruption

Any business transformation creates disruption by design, but there’s productive and unproductive disruption. AI can drive the former by enabling the smooth transfer of experience and expertise, automating many aspects of operations, and more.

AI-powered tools can be the foundation of unified systems where key information is stored, communication is delivered and employees can go for questions regarding the deal or integration. All of this reduces the confusion, uncertainty and helplessness that negative disruption can foster.

Driving collaboration

AI enables the seamless flow of knowledge across teams, helping to eliminate a silo mentality and fostering a shared understanding and promoting collaboration across departments, functions and companies. This is critical during the M&A integration process.

Through natural language processing and machine learning algorithms, AI-powered platforms can analyze and categorize all the information available within the combined entity. This allows employees to quickly find relevant information and tap into their colleagues’ expertise.

For example, generative AI-powered tools, such as StarGPT, enable users to take advantage of the convenience of the AI capabilities of large language models combined with instant human expert verification. This enables smarter, faster decision-making and provides organizations with a competitive edge to outpace the competition.

Improving customer experience

AI allows help desks and service centers to instantly access customer data and insights to better serve them. AI-powered tools can also spur proactive customer efforts — for example, analyzing data on competitors, market trends and customer insights to identify untapped opportunities across segments. This allows companies to develop targeted strategies and offerings. During the M&A process, AI can help companies identify acquisition targets and assess potential gains in customer acquisition and service.

Streamlining decision-making

AI can help companies make faster, better decisions across the M&A life cycle, including deal structuring and due diligence. It can speed up your company’s analysis of financial statements and other market data while identifying potential risks.

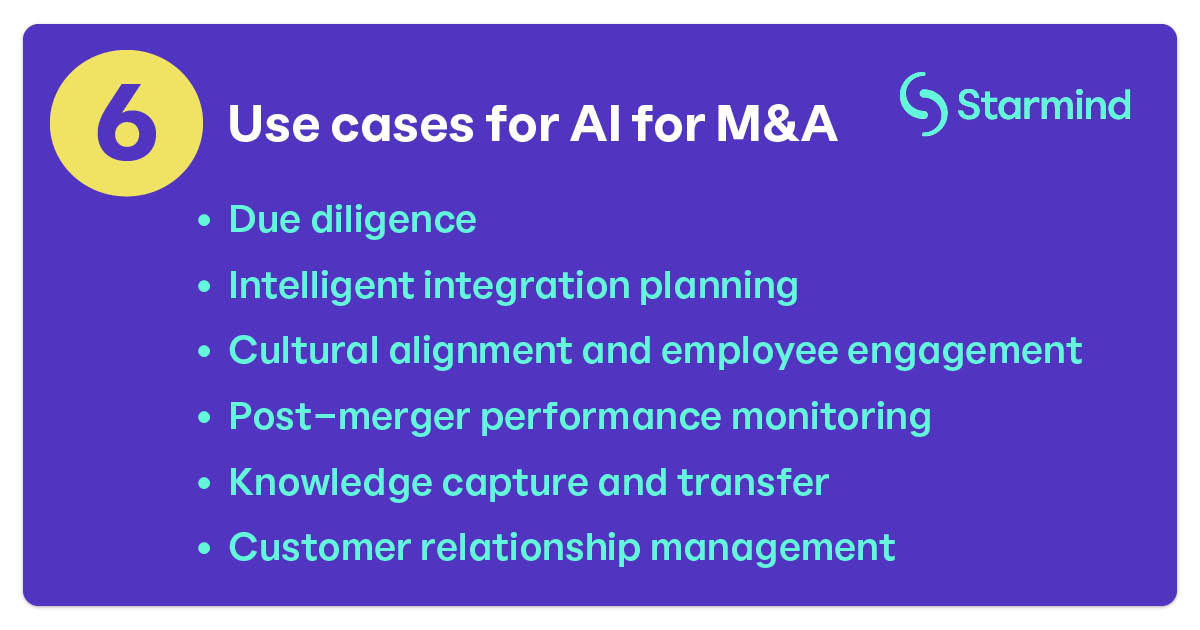

Use cases of AI for M&A

AI can be valuable at any stage of M&A, and the sooner it’s incorporated into the process, the sooner it can provide benefits. Here are some common use cases of AI for M&A.

Due diligence

Traditionally, the document review required in the due diligence stage can be time-consuming and labor-intensive, requiring teams of professionals to manually review and extract relevant information. Even with computing power, this task can be tedious and prone to errors or oversights.

AI tools for M&A can speed up and improve this stage of deal-making through automation and intelligent insights. For example, using data analytics, AI can flag irregularities in financial statements, identify potential compliance issues or highlight discrepancies in data. This saves time and reduces the risk of human error.

Intelligent integration planning

During the deal process and afterward, AI can help organizations develop comprehensive integration plans and effectively allocate resources, helping the acquiring organization quickly realize the expected benefits.

AI-powered solutions can help HR teams, for example, map each workforce’s skills against the post-merger bank of job roles. Sales teams can benefit from AI-powered analysis of sales territories, compensation differences and other crucial factors.

Post-merger performance monitoring

Because post-merger integration is a long process, organizations must be able to monitor progress objectively. AI can help do this by pulling data from across the organizations and quickly uncovering insights, trends and potential trouble spots.

These AI-based insights give organizations a holistic view of the combined entity's performance across functions, as well as let leadership intervene quickly where the integration isn’t going well.

Knowledge capture and transfer

AI can be used to capture and transfer crucial institutional, technical and employee knowledge during the M&A process and into the integration stage. Not only that, but these algorithms can identify key concepts, relationships and patterns in a unified, searchable database that immediately provides a shared repository for the combined company

An AI-powered expertise directory can also support the transfer of tacit knowledge, which is often more challenging to capture and transfer. These AI tools can instantly connect employees with knowledgeable colleagues, regardless of their role, location or even language. Employees no longer have to make guesses, access outdated or irrelevant information, or endure long waits for business-critical information

For example, a CPG company making an acquisition can use AI tools to analyze each company’s body of research, looking for similarities, differences and untapped opportunities in each team’s R&D records and product portfolio. While this can be done manually or with lesser computing power, AI can speed up this process and make deep, more complex observations that can unlock growth opportunities.

Customer relationship management

During the M&A process, it becomes even more important to effectively manage and retain customers from both companies. By using AI, organizations can improve customer relationship management, personalize customer experiences and drive retention and growth.

AI-powered systems can use customer data from both companies to create a unified view of customers, tailor experiences and target marketing campaigns. AI can also automate customer relationship management processes, such as lead scoring, customer segmentation and sales forecasting. Predictive analytics, meanwhile, can help organizations anticipate customer needs.

Transforming your business with AI for M&A

AI in M&A can reduce the risk of deal-making, speed up integration and help employees feel more comfortable and prepared to excel, no matter what other change is happening around them.

Starmind is the only AI-powered, real-time, organization-wide expertise directory, and it’s designed to help companies accelerate cycles, improve performance and increase revenue. Starmind’s AI transforms the way your team works by giving everyone instant access to expertise and providing a successful transition for everyone involved in the M&A process.

Interested in learning how Starmind can connect teams and expertise across your organization? Get in touch to discuss what an AI-powered expertise directory can do for your M&A.